Still going strong!

Last year, Hadassah focused practically an entire issue of its magazine on ‘The Art of Aging.’ The idea being, of course, that age is just a number. It’s possible, according to nearly every article in that issue, to ‘grow older, without getting old.’ Who wouldn’t appreciate that philosophy? I certainly subscribe to it.

Our articles in this section reflect the same notion as Hadassah’s—even for the oldest of seniors, our senior seniors. Check out the photo on page 17, for example, taken at Beth Sholom Village’s Annual Senior Prom. Never too old to be stylish!

And, as long as we’re talking about BSV, Abby Friedman says you’re never too young to volunteer or shop there. The article about The Village Boutique is also below.

Those on their way to “senior life” most often say that other than health, financial concerns always manage to top the list of worries. For some though, the challenge is to find the best way to give money away. Two articlesoffer suggestions.

Got some time? Simon Family JCC offers a plethora of activities…from trips and holiday celebrations to book clubs and fitness classes and apparently everything in between. Being a senior at the JCC has lots of options.

And, what would a senior section in Jewish News be without everyone’s favorite, Ruth Bader Ginsburg? She just received another award, this one from MTV. You see, age really doesn’t matter!

Our advertisers offer all sorts of services—from keeping seniors (everyone, really) physically, as well as financially healthy, and seeing and hearing well, to comfortable places to live. All good ideas.

Live well…whatever your stage!

Terri Denison

Editor

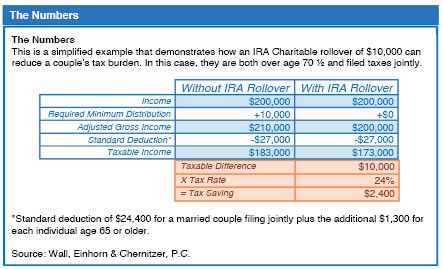

The perks of turning 70½

How an IRA Charitable Rollover gift can reduce taxes

For those age 70½ or older who want to make a lasting impact on Tidewater’s Jewish community, an Individual Retirement Account (IRA) Charitable Rollover might be worth considering. This special giving option helps tap into an asset that may not be needed all or part of and offers significant tax advantages. The result is an easy, tax-savvy gift that has the potential to help individuals make a larger philanthropic impact than previously thought possible.

An IRA Charitable Rollover (also known as a Qualified Charitable Distribution or QCD) is a withdrawal from an individual retirement account that is sent directly to a qualified public charity. A primary benefit of this option is that it keeps those funds out of the donor’s adjusted gross income (AGI). Many things are tied to AGI, including taxation of social security benefits and Medicare premiums.

This giving option has been available since 2006, but recent changes in how deductions function on federal tax returns have made it even more beneficial, making it a hot topic for financial advisors and donors looking to maximize their philanthropic impact in a tax-wise manner.

Historically, donors who give large amounts to an organization would itemize their deductions. Under the new tax law, many are often better off using the new and much larger standard deduction. However, by not itemizing, they get no tax benefit from their philanthropic gifts. This is often where an IRA Charitable Rollover makes the most sense.

With this option, the donor still receives the tax benefit from the gift, despite the changes in tax code, only now it comes in the form of an IRA withdrawal (rather than an itemized deduction) and the ability to exclude that income on their tax return. In addition, that new and much larger standard deduction still applies.

Thanks to the IRA Charitable Rollover, the AGI and ultimately, the tax liability, may all end up lower than they would be otherwise.

Tidewater Jewish Foundation is well versed in handling IRA Charitable Rollovers. Scott Kaplan, TJF CEO, says that not enough people are aware of this giving option and its many benefits.

“With recent changes in the tax law, IRA Charitable Rollovers have emerged as one of the smartest ways to make a philanthropic impact. However, this is new information for a lot of people so we are doing our best to make sure our Jewish community knows this option is available. I expect to see an increase in its utilization as more people become aware of it,” says Kaplan.

Basic facts about IRA Charitable Rollovers

- Donor must be 70 ½ to take advantage of this giving option.

- Donor can transfer up to $100,000 a year from an IRA and none of that money will be taxed as income. Also of note, that limit is per person and not per IRA. When considering ways to build a philanthropic legacy, this is a smart option.

- Gifts must be made directly from the IRA to the organization. If it passes through the donor’s hands, the tax benefits will not be received.

- IRA Charitable Distributions cannot go into a donor advised fund, but may go into an endowment or permanent fund for the benefit of one or more agencies.

- The Tidewater Jewish Foundation is a free resource that can help guide donors through this process and, if needed, can connect them with a trusted financial or legal advisor.

An IRA is built through decades of hard work and investment. That asset represents professional successes, failures, lessons learned, ladders climbed, and glass ceilings shattered. When the time comes to consider how those funds will best be used, consider contacting Tidewater Jewish Foundation so it is possible to make the greatest impact possible with a gift that makes sense for each donor, family, and community.

Contact Scott Kaplan, president and CEO at 757-965-6109 or Kaitlyn Oelsner, development associate and LIFE & LEGACY coordinator at 757-965-6103.

This information is not intended as tax, legal, or financial advice. Gift results may vary. Consult your personal financial advisor for information specific to your situation.

Kaitlyn Oelsner

Senior Adult Programming at the Simon Family JCC

Nadav Meirson leads an exercise class with seniors. Deni Budman

An array of activities for adults 55 and older are always on the Simon Family JCC’s calendar. Programs and events include educational sessions, Jewish holiday celebrations, trips, and activities to coincide with the JCC’s and United Jewish Federation of Tidewater’s programming such as Israel Today and the book and film festivals.

The JCC Seniors Club, for example, presently 65 members strong, meets the third Wednesday of every month for lunch and entertainment or a speaker. Many meetings are open to the Tidewater senior community, as was the case when a local FBI agent joined the group in February for a discussion on scamming. Another recent highlight was a session with visiting Israeli celebrity trainer Nadav Meirson in the Simon Family JCC gym. Participants connected with the instructor and were delighted to take away suggestions for a healthier lifestyle. The Club’s programming includes holiday celebrations for the High Holidays, Hanukkah, and Passover. So far this year, the Seniors Club has coordinated day trips to ODU’s Barry Art Museum and the Virginia Holocaust Museum in Richmond.

Seventeen small groups meet weekly and monthly throughout the Simon Family JCC for a variety of activities including mah jongg, knitting and crocheting for Jewish Family Service clients, current events discussion, Book Club, and Yiddish learning, to name a few.

Two new activities were added this past winter: terrarium construction and a workshop on technology skill building on laptops, tablets, and phones. The classes were well received and similar activities are being planned for the future.

The Fitness Center is a source of physical, as well as mental health. Tom Purcell and his staff have fashioned activities specifically for older users. A social aspect of working out together can be seen with many of the members of the Seniors Club who have been recruited in recent years from the water aerobics groups which have become not only fitness, but also friendship sources.

More than 300 people take advantage of these myriad groups that have social and health impacts on the participants. In fact, one participant recently noted, “I depend on this group to give me a little emotional respite from my husband’s critical illness. I can come here, play and kibbitz, and then go home refreshed and ready to support him with an upbeat attitude.”

As reported by AARP, a study by Professors Julianne Holt-Lunstad and Timothy Smith of Brigham Young University found that prolonged social isolation [in any age group but specifically in adults 55 and older] is as harmful to health as smoking 15 cigarettes a day, and is more harmful than obesity.

The Simon Family JCC offers programs to promote fun, health, physical, mental, and emotional well-being for seniors and continues to expand its repertoire to encourage older adults to stay active and social.

For more information, contact Sheryl Luebke, Simon Family JCC Senior Programs coordinator, at 757-321-2334 or sluebke@ujft.org.

Sheryl Luebke

Alice Utterback with Shelby Crockett, BSV recreation therapy aid.

BSV Senior Prom

Beth Sholom Village hosts a “Senior Prom” each year that allows residents to dress up, dance, and enjoy a sumptuous meal. The fifth annual event on May 17 took place in the Pincus Paul Room and featured a DJ.

The Village Boutique gets a new look…and so can customers

Buying local is always a good thing, but isn’t it even better when the proceeds benefit a good organization?

“It’s why I do this,” says Abby Friedman, the brains and energy behind the Beth Sholom Village Auxiliary’s unique boutique at the Berger-Goldrich Health Care and Rehabilitation Center. “I love to buy and merchandise clothes and jewelry and then help women look their best.”

Abby Friedman at the Village Boutique.

“We do not compete with the synagogue shops,” says Friedman, who stocks very little Judaica and has an eye for trends that’ll sell. “I go to vendor shows and form relationships with other providers to buy items that frankly I would wear myself.”

Friedman doesn’t have the worries of most storeowners. Though she does all the buying, displays, and price tagging, there’s no rent, salaries, or insurance to pay, and volunteers have nights, weekends, and holidays off. Plus, she’s got a great team of Auxiliary members to help round out the Boutique staff. Arlene Owens is treasurer, Marilyn Alison handles the training, and Marlene Rossen takes care of scheduling volunteers.

“What better unpaid job is there?” asks Friedman. “You work with the residents, their families, and friends and whatever we make over the cost of the merchandise, it helps Beth Sholom.”

Looking for a sundress and necklace, or purse and top? Visit Friedman at The Village Boutique. Shoppers might leave with more than a new wardrobe, and perhaps even a new place to volunteer.

Cohousing for seniors is a solution for today

An Interview with Cohousing Architect, Charles Durrett

Charles Durrett.

Charles Durrett is busy. He has been designing, teaching, and building cohousing communities in the United States since he brought the concept here from Denmark with Kathryn McCamant some three decades ago. This year, though things are different.

“Instead of working on demonstrating the value of cohousing, our firm is occupied keeping pace with a number of communities under development. I’m also just completing a new book to help others initiate their own cohousing community,” says Durrett.

Cohousing is just hitting its stride in the United States. The US Cohousing Association reports that there are currently 165 established cohousing communities with another 140 forming. Durrett is working on a dozen projects in the United States and Canada in different stages of development.

Cohousing is a planned community consisting of private homes clustered around shared space. While each attached or single-family home has traditional amenities, including a private kitchen, shared spaces reflect each community—often with a shared community kitchen, lodge house, gardens, and outdoor spaces. The legal structure is typically a homeowner association or housing cooperative.

Wolf Creek Cohousing.

Affordable living and sustainable housing concerns are major issues confronting every age group in America today. Healthy, educated, proactive adults want to live in a social and environmentally responsible community. They also seek to maintain a quality lifestyle while stretching their dollars further into the future. Millennials looking for homes are finding traditional single-family homes out of reach. Durrett is seeing family and specific populations building their own lifestyle-based housing, like LGBT Senior Cohousing in Village Hearth Cohousing in Durham, N. C., a community Durrett has helped initiate. This will be the first LGBT senior cohousing project in the U.S., and maybe anywhere.

Durrett answers a few questions about the co-housing concept:

JN: What are some of the unique characteristics of 50+ cohousing communities?

Durrett: One word: proactive. These communities are filled with individuals who are choosing to take control of their destinies through planning, not leaving things up to chance. For instance, accommodations are made for shared caregivers to live on site and long-term mobility and access issues are examined. Just the process of thinking things through as a group changes cohousing participants, preparing them with realistic views of their future.

JN: What are some mature adult cohousing benefits?

Durrett: Emotional well being, saving money through shared services and community, and maintaining independence for much longer than is commonly possible. Today, more Americans live alone in their later years, a significant health concern. This is a reflection of our culture, and one that we have the power to change. New York University sociology professor Eric Klinenberg notes that social attitudes need to progress so older people can stay connected as they age.

“Our society is evolving quickly, but probably not quickly enough,” Klinenberg noted in a post concerning end of life issues.

The biggest cohousing benefit for any community is living with kindred and having a number of close friendships. But it cannot be overlooked that cohousing costs are significantly less than other senior facilities and gives the longest possible independent lifestyle—good for living a full life and conserving financial resources.

JN: How does cohousing reduce an individual’s carbon footprint?

Durrett: Cohousing takes an individual out of the single-home mindset. Top of mind: better lifestyle, greener lifestyle. Seniors realize that it’s really okay to leave their ranchette and move closer to town knowing they will be living with people they are comfortable with and that they are creating a home they can easily maintain for the next 20+ years.

Americans drive some 5 billion miles caring for seniors in their homes (Meals on Wheels, Whistle Stop Nurses, and so on). In our small, semi-rural county in the Sierra foothills, on-demand buses alone has made 60,000 trips in massive, lumbering, polluting vans-buses—usually carrying only one senior at a time—schlepping a couple thousand seniors total over hill and dale to doctor’s appointments, to pick up medicine, or to see friends. In our cohousing community of 21 seniors, I have never seen a single on-demand bus in the driveway. In cohousing it happens organically by caring neighbors: “Can I catch a ride with you?” or “Are you headed to the drug store?”

This alternative is much more fun and inexpensive for all involved, and much less damaging to the environment. Site location that allows for walkable lifestyles is a large factor, as well. Wolf Creek Lodge, a senior cohousing community with 30 units, built on 1 acre, is within walking distance of downtown Grass Valley, population 12,000. Nevada City Cohousing is also a short stroll to the downtown historic district.

Cohousing is a mind shift that is not just greener—it makes a better life.

JN: How would cohousing affect my retirement planning?

Durrett: Cohousing is a proactive, realistic way of addressing issues. It’s an ultra-responsible approach to assessing how to provide for one’s own future. Everyone in the process is dealing with understanding that mortality is real and that aging successfully means examining the whole person benefits—economic, emotional and physical well being.

Cohousers choose to place themselves in a fun, life-affirming, and embracing community. The big thing here is that by living independently longer, money is saved at every juncture, so by taking control, resources can go much further. Turns out that an independent, quality life costs less than facilitated retirement.

JN: What kind of start-up process is involved?

Durrett: First off, contact a cohousing company. They will find out what considerations and requirement are needed for your specific area. They will also be able to guide you in forming a group.

Next, start talking to friends. Host a presentation in your town, secure a site. You may already know some of your new cohousing neighbors.

Don’t let your Social Security check go on vacation

If you are like most people on Social Security, you’ve found a use every month for that check. For others, that check is essentially bonus money, totally unnecessary for day-to-day survival.

“That situation is not as unusual as many may think,” says Jeffrey Eglow, chief investment officer for Guardian Wealth Advisory (www.guardianwealthadvisory.com). “Some people may have inherited an income, won a lottery, or had investments that did really well.

“But just because they don’t need that Social Security money to live on, it doesn’t mean they shouldn’t make the most of it. There are some specific things they should do to make sure they are getting the maximum benefit.”

Eglow says that many baby boomers see their investments and retirement income differently than they did before the 2008 recession. They are looking for sources of guaranteed income instead of more risky investments. While Social Security is guaranteed income, if they are wise about how they leverage it, they can have even more guaranteed income, he says.

Eglow says strategies for people who are in this situation include:

- Don’t take Social Security until you are 70. This is the best strategy since there are few investments that offer a similar low risk, guaranteed 8 percent annual growth. By waiting until age 70 to receive benefits, your monthly payments may increase by as much as 32%, not including any cost of living increases that may be added to this amount. For example, someone who could get $2,000 a month at the “full retirement age” of 66 would get $2,640 if they postponed taking Social Security until they were 70.

- Spend the Social Security check instead of 401(k) or IRA funds. Most people are taxed on only 50 percent to 85 percent of their Social Security benefit. But they are taxed on 100 percent of any withdrawals from traditional IRAs or 401(k) accounts.

- Give it to the kids. Use the Social Security checks to pay premiums on life insurance policies so your heirs will receive a larger inheritance. Your heirs will receive this death benefit tax free.

- Don’t delay getting Social Security past 70. Since the benefit stops growing at 8 percent once the beneficiary reaches 70, it makes no sense to delay the start of getting the checks past that age.

Eglow says even if some people don’t need their Social Security check for day to day living, it is still foolish to not maximize its value so it can benefit them and their families.

Miriam Adelson is Israel’s richest person, with $22 billion

JERUSALEM (JTA)—Dr. Miriam Adelson, the wife of American casino magnate Sheldon Adelson, is Israel’s wealthiest person for 2019, according to a biannual list.

The Haaretz daily newspaper’s Israel’s rich list published Wednesday, June 19, notes that Israel has 128 billionaires after having only eight in 2003.

Miriam Adelson, 73, is new to the list and jumped right to the top spot, “thanks to a recent transfer of assets from her husband,” according to Haaretz.

Adelson’s personal wealth is placed at $22 billion, most of it in shares in the Las Vegas Sands Corp. given to her last year by her husband, according to the report. Adelson also controls the free distribution newspaper Israel Hayom as its publisher.

Russian-born Roman Abramovich, 52, owner of the Chelsea FC soccer team, last year became the richest person ever to immigrate to Israel and claim citizenship. He comes in on the list at No. 2 with his total wealth valued at $13 billion.

Here is the rest of the top 10:

3. Eyal Ofer, son of the late billionaire Sammy Ofer, at $10.7 billion, mostly in real estate holdings and shipping;

4. The Wertheimer family led by patriarch, Iscar founder Stef Wertheimer, $9.5 billion;

5. French-Israeli telecom magnate Patrick Drahi, who earlier this month purchased Sotheby’s auction house, $8.75 billion;

6. The Azrieli family, which invests in real estate and owns shopping malls, $5.54 billion;

7. Businesswoman Shari Arison, who recently liquidated most of her holdings in Israel, $5.5 billion;

8. Gil Shwed, who co-founded Check Point Software Technologies, $4.7 billion;

9. Idan Ofer, $4.5 billion; and

10. The Tshuva family, whose wealth comes from natural gas, $4.15 billion.

Other notables:

17. Israeli-American media mogul Haim Saban of Power Rangers fame, $2.9 billion;

21. The Strauss family, owner of the third-largest food products manufacturer in Israel, $2.2 billion; and

30. Sylvan Adams, who brought the Italian bicycle race Giro d’Italia to the country last year, underwrote Madonna’s performance at the Eurovision Song Contest in Tel Aviv and is heir to a real estate empire started by his father, $1.7 billion.

Marcy Oster

Findings released from first national study of Jewish grandparents

The first-ever national study of Jewish grandparents—commissioned by the Jewish Grandparents Network (JGN), in partnership with 17 national organizations and Jewish Federations—provides rich and detailed information about the demographics, attitudes and beliefs, behaviors, and needs of today’s Jewish grandparents. Nearly 8,000 individuals, (approximately 1,000 of them from a nationally representative sample), participated in the study. Key findings include:

The first-ever national study of Jewish grandparents—commissioned by the Jewish Grandparents Network (JGN), in partnership with 17 national organizations and Jewish Federations—provides rich and detailed information about the demographics, attitudes and beliefs, behaviors, and needs of today’s Jewish grandparents. Nearly 8,000 individuals, (approximately 1,000 of them from a nationally representative sample), participated in the study. Key findings include:

- While the vast majority of Jewish grandparents find grandparenting to be a joyful experience, grandparenting can have its difficulties.

- Most grandparents are committed to transmitting Jewish values.

- Nearly half of the grandparents in the national representative sample have a child married to a non-Jewish partner.

- Most frequently, interactions between grandparents and their grandchildren take place in their homes and their grandchildren’s homes, around birthdays and national holidays.

According to David Raphae, co-founder and CEO of the Jewish Grandparents Network, “The challenge for the Jewish community is to pivot towards the wonderful opportunity to engage grandparents in ways that ultimately bring the entire family together in meaningful Jewish experiences. Grandparents really can be partners in the Jewish engagement work that so many communities look to do.”

The study identified five segments or groupings of Jewish grandparents, based on shared attitudes and beliefs:

- Joyful Transmitters (20%)—love being grandparents and feel it’s important to transmit Jewish values and beliefs.

- Faithful Transmitters (16%)—want their grandchildren to have a strong connection to Judaism and to marry Jews.

- Engaged Secularists (23%)—engaged grandparents, but don’t model Jewish involvement for their grandchildren.

- Wistful Outsiders (20%)—want to be more involved with their grandchildren, but family dynamics get in the way.

- Non-Transmitters (20%)—not Jewishly-engaged nor interested in passing on Jewish practices to their grandchildren.

The segmentation provides rich insights into each cohort’s attitudes, practices, needs, and interests and can provide significant insights to Jewish organizations and communities on effectively engaging Jewish grandparents in Jewish communal life.

According to Lee M. Hendler, co-founder and president of the Jewish Grandparents Network, “Grandparents are saying, work with us! Jewish transmission is our legacy and the ways and places we interact with our families have changed.” The study’s findings have generated significant interest among Jewish organizations and in Jewish communities across the nation.

Presentations of the findings at the Jewish Funders Network Annual Conference, International Lion of Judah Conference, Jewish Community Center Association Executive Leadership Mifgash, Jewish Federation of North America Professional Institute, the PJ Library Annual International Conference and the Network of Jewish Human Service Agencies Annual Conference, among others, have been received enthusiastically.

The Jewish Grandparents Network is the first and only national organization empowering grandparents as they embrace both traditional and radically new roles in their families. Through research, network-building, advocacy, and institutional partnerships, the group fosters new models of grandparent engagement for the benefit of Jewish families, Jewish communities, and a Jewish future.