This is the time of year we think about other people, friends and family. This year, I hope you will also think about your community and the many ways you can make a difference.

Before 2016 comes to an end, consider these exciting programs and matching gift opportunities through the Tidewater Jewish Foundation (TJF) that will help make a difference, while supporting your Jewish community.

Below are a few of the ways your family can make an impact today and for future generations during this holiday season.

This Hanukkah commit to at least one family day of giving to others

At Hanukkah, consider dedicating one night to giving to others. Incorporate the concept of “Tikkun Olam” (repairing the world) into Hanukkah by on one night, after lighting the candles and in lieu of presents, talking with your children about making a gift to a favorite Jewish charity as a family. Talk about what is meaningful and important to each of you. To create a family philanthropic fund, read below to learn how you can incorporate philanthropy with your family throughout the year. Join me and my family, as we continue this tradition of giving to others in need at Hanukkah.

Create a Donor Advised Fund (DAF)

If you make charitable contributions to one or more organizations on an annual basis, you may consider establishing a Donor Advised Fund (philanthropic fund) with TJF. For a limited time, if you establish a new Donor Advised Fund (DAF) through TJF with at least $7,500, TJF will match your gift with an additional $2,500 totaling $10,000 or more. A DAF allows you to make charitable gifts into the fund at any time and retain the ability to make distribution requests from the fund to charitable organizations of your choice (Jewish or non-Jewish). Think of it like a charitable parking lot to maintain all of your philanthropy, managed through our online donor portal, providing 24/7 access. You may also name your child(ren) as successor advisor(s) to your fund. This fund may be established by an individual, a couple or a family.

B’nai Tzedek Teen Philanthropy (a teen philanthropic fund)

If you are a teenager, have one in your home or simply know a teenager (or grandchild), consider establishing a B’nai Tzedek Teen Philanthropy Fund in his/her/their name. With an initial gift of $250, a teen can have their own philanthropic fund (a mini Donor Advised Fund). TJF will match gifts (up to $250) simply for establishing the fund with us. This is a fantastic opportunity to use some bar/bat mitzvah gifts and learn how to become a philanthropist and create a mini-version of a regular Donor Advised Fund.

Legacy Match Life Insurance Program

Life insurance can be used to make a significant philanthropic impact in our community for generations to come. Another great matching opportunity is through the gift of life insurance where the Jewish community is the beneficiary of your policy. TJF now offers a 35% match of premiums for specific types of policies.

Life & Legacy

TJF was recently selected to participate in the Harold Grinspoon Foundation’s Life & Legacy program, which includes a total of 37 different Jewish communities. Life & Legacy is a four-year program that assists communities, through partnerships with Jewish Federations and Foundations, to promote after-lifetime giving to benefit local Jewish day schools, synagogues, social service organizations and other Jewish entities. Since TJF was chosen to lead this initiative for the Tidewater Jewish community, 10 local organizations applied and have been accepted to participate, including: Congregation Beth El, Toras Chaim Day School, Hebrew Academy of Tidewater, Ohef Sholom Temple, Beth Sholom Village, Jewish Family Service, United Jewish Federation of Tidewater, Temple Emanuel, Chabad of Tidewater, and Simon Family Jewish Community Center.

The Harold Grinspoon Foundation will grant Tidewater Jewish Foundation with matching funds of up to $100,000 per year to provide the participating organizations the opportunity to receive unrestricted incentive grants based on meeting legacy commitment benchmarks. In January, the opportunity to participate by making a commitment to leave a legacy to one or more Jewish organizations will be available to everyone.

Charitable IR A Roll Over

The charitable IRA rollover, or qualified charitable distribution (QCD), is a special provision allowing certain donors to exclude from taxable income—and count toward their required minimum distribution (RMD)—certain transfers of Individual Retirement Account (IRA) assets that are made directly to public charities. This provision was made permanent at the end of 2015 and therefore is in place for 2016 and 2017. In order for a gift to qualify for the charitable IRA rollover, the gift must be made by a donor age 70½ or older and must be transferred from a traditional or Roth IRA directly to a permissible public charity (such as Tidewater Jewish Foundation for the benefit of one or more organizations). The gift must be completed during the applicable tax year. An individual taxpayer’s total charitable IRA rollover gifts cannot exceed $100,000 per tax year. If you have not already taken your required minimum distribution (RMD), a qualifying rollover gift may count toward satisfying this requirement. Consult your own professional advisor (tax, legal, financial) to learn how this provision may apply to your specific situation.

Gifting of Appreciated Securities

The end of year is a great time to consider a charitable contribution of long-term appreciated securities (e.g. stocks, bonds and/or mutual funds that have realized significant appreciation). It is one of the most tax-efficient ways to give. Long-term appreciated securities with unrealized gains (meaning they were purchased over a year ago, and have a current value greater than their original cost) may be donated to a public charity (such as TJF) and a tax deduction taken for the full fair market value of the securities—up to 30% of the donor’s adjusted gross income. Since the securities are donated rather than sold, capital gains taxes from selling the securities may be avoided. The more appreciation the securities have, the greater the tax savings. Appreciated securities may be gifted directly to the Tidewater Jewish Foundation into a current fund or create a new fund, such as a Donor Advised Fund (see above) to benefit one or more organizations now and in the future. You may receive your tax deduction at the time of the gift and determine at a later date (in 2017 or beyond) which organizations will receive distributions from the fund.

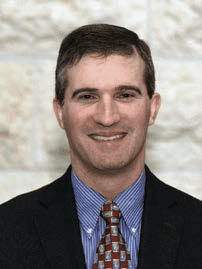

To discuss any of these programs, gifting options and specific goals and objectives, and to learn what is right for you and your family, consider setting up a confidential conversation with Scott Kaplan, Tidewater Jewish Foundation president & CEO. Call 757-965-6109 or email at skaplan@ujft.org.