For those who are 70½ or older who have an Individual Retirement Account (IRA) and want to make a lasting impact on Tidewater’s Jewish community, an IRA Charitable Rollover with the Tidewater Jewish Foundation might be worth considering. By tapping into this asset, individuals are able to make a larger philanthropic impact than previously possible and enjoy significant tax advantages.

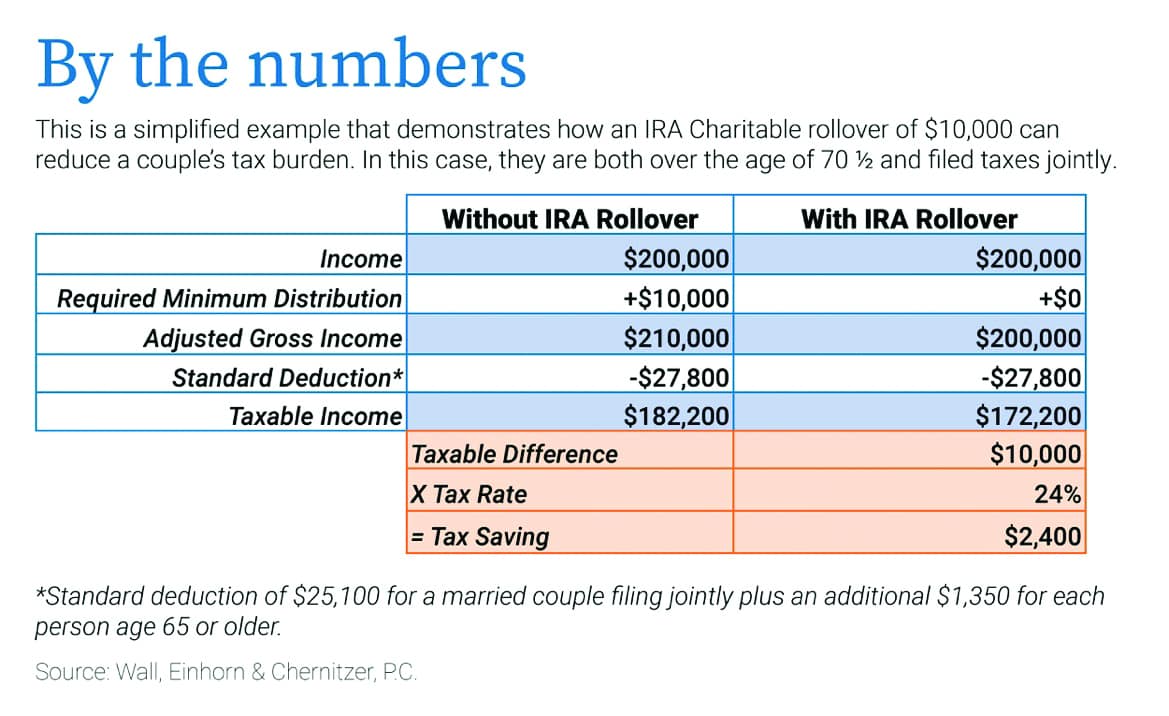

An IRA Charitable Rollover, also known as a Qualified Charitable Distribution (QCD), is a withdrawal from an individual retirement account that is sent directly to a qualified public charity. A primary benefit of this option is that it keeps those funds out of the donor’s adjusted gross income (AGI). Required minimum distributions (RMDs) must be taken from the IRA and will add to a donor’s AGI by April 1 of the year following the year in which they turn 72 (70½ if they reached 70½ before January 1, 2020) regardless of whether they are still employed.

“While a Charitable IRA Rollover may not be directed to a donor-advised fund, there are several ways to give through the Charitable IRA Rollover to leave a legacy gift, such as to direct dollars to a specific nonprofit organization, unrestricted funds, field of interest funds or other designated funds,” says Naomi Limor Sedek, TJF president and CEO. “Our Foundation professionals happily work with donors to structure Charitable IRA Rollovers to achieve their desired impact.”

Historically, donors who give large amounts to an organization would itemize their deductions. Under the tax law, many are often better off using the much larger standard deduction. By not itemizing, however, they get no tax benefit from their philanthropic gifts. This is often where an IRA Charitable Rollover can be advantageous.

With this option, the donor receives the gift’s tax benefit, only now it is in the form of an IRA withdrawal (rather than an itemized deduction) and the ability to exclude that income on their tax return. In addition, the much larger standard deduction will still apply.

Basic facts about IRA Charitable Rollovers

• Donor must be 70½ years old.

• Donors can transfer up to $100,000 a year from an IRA, which will not be taxed as income. Limit is per person, not per IRA.

• Gifts must be made directly from the IRA to the organization. If not, the tax benefits will not be received.

• IRA Charitable Distributions cannot go into a DAF (donor advised fund) but may go into an endowment or permanent fund for the benefit of one or more agencies.

Consider contacting Tidewater Jewish Foundation to learn more about how to make the greatest impact possible with a gift that makes sense for each donor, family, and community.

For more information, contact Naomi Limor Sedek, at nsedek@ujft.org or 757-965-6109.

This information is not intended as tax, legal, or financial advice. Gift results may vary. Consult your personal financial advisor for information specific to your situation.

– Thomas Mills